⚠️ Disclaimer

This article is for educational purposes only. It does not provide financial or investment advice. All content complies with legal standards in Kazakhstan, Russia, and the United States.

🔍 What Is Ethereum, Really?

Ethereum isn’t just a cryptocurrency. It’s not just “number go up” on a price chart. And it’s definitely not Bitcoin’s little brother.

Ethereum is a programmable blockchain — a kind of decentralized world computer that can run applications, automate agreements, and build financial systems… without any middlemen, banks, or big tech platforms.

If Bitcoin was the first hammer that cracked the wall of traditional finance, Ethereum is the toolbox.

You’ve probably heard of NFTs, DeFi, DAOs, or even play-to-earn games. They all live, breathe, and operate on Ethereum.

But if you’re not a developer or blockchain nerd, Ethereum might feel like some mysterious black box. Let’s open it.

👶 The Origin Story: Built by a Teenager with a Vision

In 2013, a 19-year-old Russian-Canadian named Vitalik Buterin had a radical idea: What if we could build programmable money?

He had been writing for Bitcoin Magazine and diving deep into Bitcoin’s code. He admired it — but found it too limited. You could send and receive BTC, but not much else.

“Bitcoin is like a calculator,” Vitalik wrote. “Ethereum is like a smartphone.”

So he wrote a white paper — just 9 pages — describing a new kind of blockchain. One that could run smart contracts: code that executes automatically and lives on-chain.

By 2014, the idea caught fire. Vitalik assembled a team of now-legendary co-founders:

- Gavin Wood – wrote the Ethereum Yellow Paper and created Solidity

- Joseph Lubin – later founded ConsenSys

- Charles Hoskinson – eventually created Cardano

- Plus: Mihai Alisie, Anthony Di Iorio, and Amir Chetrit

That same year, Ethereum held one of the first major ICOs (Initial Coin Offerings) — raising over $18 million in Bitcoin. The main network launched on July 30, 2015, under the name Frontier.

⚙️ How Ethereum Works

At its core, Ethereum is a blockchain, just like Bitcoin. It’s a database shared across thousands of computers that can’t be changed after the fact.

But Ethereum isn’t just a database — it’s a global computer. A computer that doesn’t belong to anyone, can’t be turned off, and executes code exactly as written.

🧠 Smart Contracts

Smart contracts are pieces of code that live on Ethereum. Think of them like vending machines:

- You put in a token

- The machine checks the conditions

- If all is good, it dispenses the product

Example: A smart contract could hold funds in escrow and only release them when two parties agree.

These contracts are self-executing, tamper-proof, and transparent. They don’t need lawyers, banks, or paperwork. They just run.

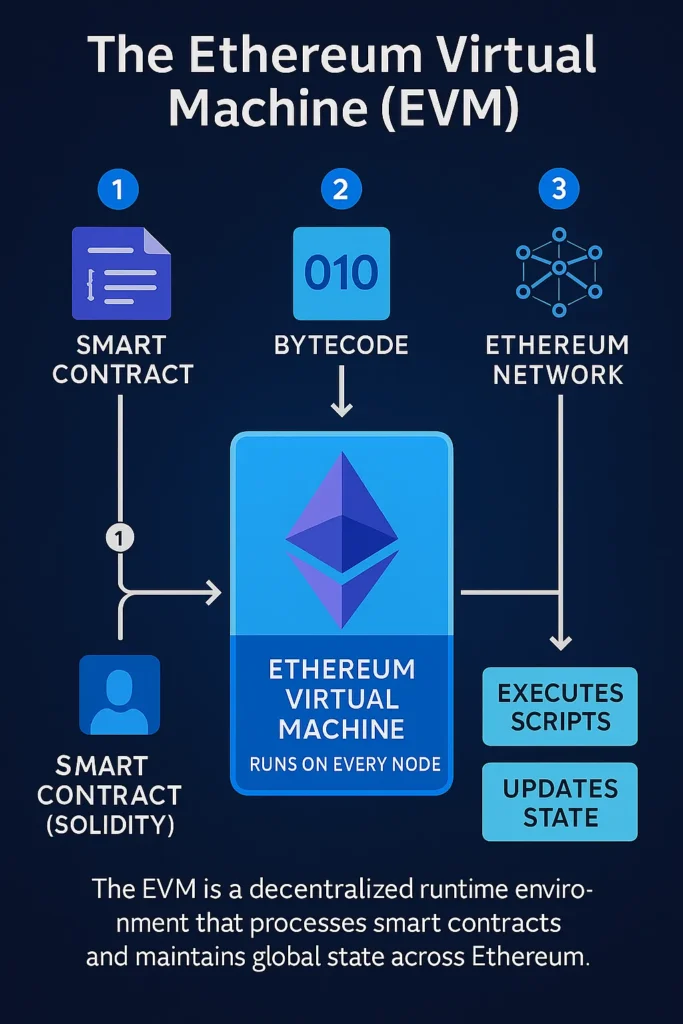

⚙️ The Ethereum Virtual Machine (EVM)

Every smart contract runs on the EVM — Ethereum’s sandboxed, Turing-complete computing engine. It’s like the operating system behind the scenes.

Developers write contracts in Solidity, which is compiled into EVM bytecode.

Every Ethereum node runs the EVM, making sure everyone sees the same result — globally.

⛽ What’s “Gas” and Why Does It Cost Money?

Imagine you’re driving a car. The more miles you go, the more gas you burn. Same in Ethereum.

Each operation — whether it’s sending ETH, minting an NFT, or interacting with DeFi — consumes gas, which you pay in gwei (a tiny fraction of ETH).

- Complex operations = more gas

- More congestion = higher prices

- Gas protects the network from spam and compensates validators for work

| Unit | Meaning |

|---|---|

| ETH | Native currency of Ethereum |

| Gwei | 1 ETH = 1,000,000,000 gwei |

| Gas | Measurement of computation |

⚔️ Ethereum vs Bitcoin: Not the Same Battlefield

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Purpose | Digital money | Decentralized app platform |

| Supply Cap | 21 million (fixed) | No cap, but burning offsets growth |

| Smart Contracts | Limited | Core functionality |

| Programming | Basic scripting | Full Turing-complete VM |

| Energy | Proof of Work | Now Proof of Stake |

Ethereum is not trying to be better than Bitcoin — it’s trying to do something entirely different.

🔁 The Merge: A Historic Shift to Sustainability

On September 15, 2022, Ethereum pulled off the biggest upgrade in blockchain history — known as The Merge.

It moved from Proof of Work (energy-intensive mining) to Proof of Stake (environmentally friendly validation).

🧬 What Changed?

- 🛑 No more mining.

- 🌱 Energy use dropped ~99.95%

- 💸 ETH became slightly deflationary (more burned than issued)

- 🔐 Validators now secure the network by staking 32 ETH

The Merge wasn’t just an upgrade. It was a philosophical pivot. Ethereum proved a blockchain could evolve — without stopping the machine.

📊 Ethereum in Numbers (Mid-2025 Snapshot)

| Metric | Value |

|---|---|

| ETH Price | ~$3,200 USD |

| Market Cap | ~$390 billion USD |

| Active Validators | ~950,000 |

| Daily Transactions | ~1.2 million |

| Average Gas Fee | $1.50–$4.00 USD |

| Total ETH Supply | ~118 million (deflationary) |

| TVL (DeFi on Ethereum) | ~$120 billion USD |

🧱 What You Can Actually Do With Ethereum

Ethereum isn’t just a whitepaper fantasy. It’s real infrastructure.

🏦 Use Case 1: Decentralized Finance (DeFi)

Want to earn yield, borrow crypto, or swap tokens? You can do that without a bank:

- Uniswap — trade any ERC-20 token, instantly

- Aave — borrow stablecoins using ETH as collateral

- MakerDAO — mint decentralized stablecoin DAI

All without signing up or trusting anyone.

🎨 Use Case 2: NFTs and Ownership

Ethereum is home to ERC-721 and ERC-1155 — standards for non-fungible tokens:

- Art (e.g., CryptoPunks)

- Collectibles (e.g., Bored Apes)

- Game assets, concert tickets, and even academic credentials

NFTs are about proving digital ownership — in a way that’s impossible to fake.

🧠 Use Case 3: DAOs (Decentralized Autonomous Organizations)

DAOs are like internet-native companies governed by code and community votes:

- No CEOs

- No HR departments

- Everything is transparent and on-chain

🌉 Scaling the Future: Ethereum’s Layer 2 Revolution

As Ethereum grew more popular, it also became… expensive.

In 2021–2023, simple transactions could cost $50–$100. Why? Every operation had to be processed on the main chain (Layer 1). That’s like trying to run New York’s entire subway system through a single turnstile.

🧩 Enter Layer 2 (L2)

Layer 2 networks are built on top of Ethereum. They execute transactions off-chain and then submit compressed proofs to the main network.

Think of them as express lanes on a traffic-jammed highway — fast, cheaper, and secure.

| L2 Solution | Type | What It Does |

|---|---|---|

| Arbitrum | Optimistic Rollup | Cheap gas fees, compatible with dApps |

| Optimism | Optimistic Rollup | Powers Coinbase’s L2 chain (Base) |

| zkSync Era | ZK-Rollup | Ultra-low fees, high throughput |

| StarkNet | ZK-Rollup | Based on STARK cryptography |

Projects on L2 still benefit from Ethereum’s security — because the final results settle back on the main chain.

🪙 Token Standards Explained: ERC What?

Ethereum isn’t just about ETH. It’s a platform for creating new digital assets, thanks to well-defined technical standards.

Here are the most important ones:

| Token Standard | What It Does | Examples |

|---|---|---|

| ERC-20 | Fungible tokens | USDC, LINK, UNI, APE |

| ERC-721 | Non-fungible tokens (NFTs) | CryptoPunks, Art Blocks |

| ERC-1155 | Semi-fungible, efficient for games | Enjin, gaming assets |

Each standard defines how a token should behave — making it easier for wallets, marketplaces, and dApps to support them universally.

Without these standards, the Ethereum ecosystem would be chaos. Standards are what made the App Store work — and the same applies here.

🏗️ Ethereum’s Timeline of Major Upgrades

Ethereum evolves through hard forks — major protocol upgrades named like science fiction novels. Each one pushes the network forward:

| Upgrade Name | Year | What It Brought |

|---|---|---|

| Frontier | 2015 | First version of Ethereum mainnet |

| Homestead | 2016 | Stability, tools, infrastructure |

| Byzantium | 2017 | Cryptographic upgrades, privacy primitives |

| Constantinople | 2019 | Gas optimizations, smart contract tweaks |

| Istanbul | 2019 | Better zk-SNARK support |

| London (EIP-1559) | 2021 | Base fee burn mechanism → deflationary ETH |

| The Merge | 2022 | Shifted from PoW to PoS |

| Shanghai (Capella) | 2023 | Enabled withdrawals for staked ETH |

And next?

- Verkle Trees – Drastically reduce storage needs

- Danksharding – Supercharges scalability via data availability sampling

- Stateless Ethereum – Make nodes run with minimal data

Ethereum isn’t standing still. It’s rebuilding itself in motion — something few networks, or companies, have ever done successfully.

⚖️ Is Ethereum Legal?

Yes — owning and using Ethereum is legal in most jurisdictions, including Kazakhstan, Russia, the United States, and the European Union.

But laws vary by region, especially for:

- Taxation

- Trading platforms

- Initial token offerings (ICOs)

- Anonymity tools (like Tornado Cash)

| Region | Legal to Own ETH | Notes |

|---|---|---|

| Kazakhstan | ✅ Yes | Trading via licensed platforms only |

| Russia | ✅ Yes | Cannot use for payment; must report assets |

| USA | ✅ Yes | Subject to SEC scrutiny for some tokens |

| EU | ✅ Yes | Subject to MiCA regulation starting 2025 |

⚠️ You can write, explain, and educate about Ethereum legally — just avoid investment advice or unregistered promotions.

🔐 Ethereum Security: Has It Been Hacked?

Ethereum’s core protocol has never been compromised.

But apps built on top of it? That’s another story.

🔥 Notable Incidents:

- The DAO Hack (2016) — A smart contract bug let an attacker steal $60M. Led to a controversial hard fork.

- Parity Wallet Bug (2017) — $150M in ETH locked forever due to code error.

- Bridge Attacks (2022–2023) — Projects like Ronin, Wormhole, and Harmony lost hundreds of millions. Most breaches involved third-party code, not Ethereum itself.

🧰 How Security Has Evolved:

- Code audits from firms like Trail of Bits, OpenZeppelin

- Formal verification tools for contract logic

- Bug bounty programs (Immunefi has paid out millions)

- Community education: “Don’t trust, verify — and audit.”

Smart contracts are powerful, but they’re still code. And bugs in code can be more expensive than in banks.

🔮 What’s Next for Ethereum? Realistic, Radical, and Ready

Ethereum isn’t finished. It’s not even close.

Despite being a multi-billion-dollar ecosystem powering everything from stablecoins to social tokens, Ethereum is still in mid-transformation. Its developers — and its users — see it not as a product, but as a living infrastructure. And what’s coming next will redefine its capabilities entirely.

Let’s break down where Ethereum is headed in the next 2–5 years — not in vague hype, but in actual roadmap goals.

🌿 1. From “Expensive” to “Scalable”

Ethereum’s biggest challenge has always been its success.

With millions of users, the network gets congested, fees spike, and critics scream. That’s exactly why Ethereum is pursuing the “rollup-centric roadmap.”

Instead of scaling Layer 1 (the base chain), Ethereum embraces Layer 2s like Arbitrum and zkSync to handle the heavy lifting.

But it doesn’t stop there.

Upcoming scalability upgrades include:

- Danksharding – a reimagining of sharding that lets Ethereum handle 100,000+ transactions per second, not 30. It uses data blobs and data availability sampling instead of full chain validation.

- Proto-danksharding (EIP-4844) – already underway; it’s the precursor to full danksharding and will reduce L2 fees by 10x or more.

- Stateless Ethereum – a future where validators don’t need to store the whole chain history, drastically improving decentralization and performance.

In other words: Ethereum wants to become the world’s most flexible settlement layer, while offloading most activity to L2s that are fast, cheap, and app-specific.

🔐 2. Privacy Is Coming (Legally)

For years, Ethereum had a privacy problem: everything was visible.

Every transaction, every wallet, every action — all public, forever. That’s transparent, sure — but it also makes it impossible to do things like payroll, voting, or healthcare on-chain.

But privacy doesn’t mean secrecy. It means selective disclosure — and Ethereum is embracing it carefully.

What to watch:

- zk-SNARKs and zk-STARKs – zero-knowledge proofs will allow private transactions with verifiable correctness

- zkID / zkKYC – ways to prove you’re qualified (e.g., age, citizenship) without revealing your identity

- Shielded DeFi – private vaults and swaps where balances aren’t publicly visible

The key is doing all this without violating regulation. Ethereum is now exploring tools for compliant privacy — privacy that works with AML laws, not against them.

🧠 3. Smart Contracts Will Get… Smarter

Right now, smart contracts are powerful but dumb. They can only act on what’s inside Ethereum. They don’t know the weather, the news, or what happens in the real world.

That’s changing, thanks to:

- Chainlink oracles – bridges between blockchain and real-world data

- AI integrations – early experiments with on-chain AI logic (like prediction models or game theory engines)

- Account abstraction (ERC-4337) – coming soon, it will let wallets act like smart contracts themselves. No more seed phrases. No more fear of losing your keys.

Ethereum is becoming not just programmable, but user-friendly, safer, and more intelligent.

🪙 4. ETH as Ultrasound Money

After The Merge, Ethereum started burning ETH with every transaction (via EIP-1559). At times, it burns more ETH than it issues — making it deflationary.

Combine that with:

- Low inflation (0.5–1%)

- Staking rewards

- Network demand from NFTs, DeFi, and L2s

…and many now call ETH “ultrasound money” — a digital asset with predictable issuance, declining supply, and actual use.

Unlike Bitcoin, which is mostly inert digital gold, ETH has velocity: it gets used, moved, locked, and earned.

The long-term vision? ETH could become the native collateral of the internet.

🌐 5. Ethereum as a Political Force

Ethereum is not just a protocol. It’s becoming a political platform — one that powers movements, not just markets.

We already see:

- Public goods funding via Gitcoin

- Quadratic voting in DAOs

- Decentralized media with built-in funding (e.g., Mirror.xyz)

- Censorship resistance in authoritarian regimes

As the real world wrestles with platform bans, financial surveillance, and centralized control, Ethereum offers a different path:

A programmable layer for law, rights, and value — written in code, not paper.

🚀 In Short: Ethereum’s Best Years Aren’t Behind It — They’re Just Loading

Ethereum is like the early internet: weird, brilliant, frustrating, and absolutely world-changing. It’s messy. It’s political. It’s technical. But it’s here to stay.

And what’s next?

- 100x scalability

- Legal privacy

- Smarter apps

- Safer wallets

- Global on-chain institutions

Whether you’re a builder, an analyst, or just someone trying to understand what’s going on in crypto… Ethereum isn’t just worth watching.

It’s worth understanding — because it’s building the rails of tomorrow’s digital civilization.

📘 Glossary: Speak Ethereum Without Pretending

| Term | Meaning for Humans |

|---|---|

| ETH | Ethereum’s native currency |

| Gas | Fee for computation on the network |

| EVM | Ethereum’s virtual brain |

| Smart Contract | Code that runs exactly as written |

| DAO | Online organization run by token-holders |

| L2 | Scalable network built on top of Ethereum |

| PoS (Proof of Stake) | Energy-efficient way to secure the network |

| TVL (Total Value Locked) | Amount of crypto locked in DeFi apps |

❓ Frequently Asked Questions

Q: Can I mine Ethereum today?

🛑 No. Since 2022, Ethereum has used Proof of Stake — mining is gone.

Q: Is Ethereum anonymous?

Not really. It’s pseudonymous. All transactions are public, but tied to wallet addresses, not names — unless linked.

Q: What’s the safest wallet for Ethereum?

Cold wallets (Ledger, Trezor) offer the best protection. MetaMask is great for everyday use but riskier due to phishing/browser attacks.

Q: Can Ethereum be banned?

Governments can block access to apps, but Ethereum itself is decentralized. As long as one node exists, it survives.

Q: Is Ethereum a good investment?

This article is not financial advice. Ethereum is a powerful protocol — but markets are volatile. Research, understand, and protect yourself.

🧠 Final Thoughts: Ethereum Is More Than Just Code

Ethereum is not a coin. It’s not a stock. It’s not even just a technology.

Ethereum is an idea — that trust can be automated, that software can replace bureaucracy, and that code can build consensus where politics fails.

Yes, it’s complex.

Yes, it has fees.

Yes, it’s still evolving.

But no other blockchain has attracted more developers, more apps, or more innovation. From NFTs to decentralized identity, from prediction markets to open finance — Ethereum is where it all started.

Whether you’re a student, a builder, or just crypto-curious, Ethereum deserves your attention — not because it’s hype, but because it’s infrastructure for a more programmable world.

In the end, Ethereum is what the internet might have been — if we had rebuilt it with transparency, logic, and permissionless access.