⚠️ Disclaimer

This article is for educational purposes only. It does not constitute investment advice or endorse any cryptocurrency. All content complies with legal standards in Kazakhstan, Russia, and the United States.

🔍 Introduction: Why Bitcoin Burns More Energy Than Countries

Every time you swipe your card or transfer money online, banks and servers silently verify the transaction. But in the world of cryptocurrency, something far more intense happens: a global race among computers to solve complex puzzles — all for the chance to win a block reward.

This is Proof of Work (PoW). It’s the original and most battle-tested consensus mechanism in blockchain. It’s also the reason why Bitcoin consumes more energy than some nations.

Let’s break it down — the math, the machines, the madness — and explore whether Proof of Work still deserves its throne in the blockchain world.

🔧 What Is Proof of Work?

Proof of Work is a consensus algorithm. That means it’s a method to ensure that all nodes in a blockchain network agree on the same version of the truth.

But instead of trust, PoW uses brute computational force:

- Miners compete to solve a cryptographic puzzle by brute-force guessing trillions of hashes per second.

- The first one to solve it gets to add a new block to the blockchain.

- In return, they receive a reward (e.g., 6.25 BTC per block as of 2025).

This process:

- Ensures immutability (you can’t alter past blocks without redoing all the work).

- Prevents double spending (a major risk in digital currency).

- Provides network security by making attacks computationally expensive.

🔬 How It Works (Step-by-Step)

Here’s a simplified version of how PoW functions behind the scenes:

| Step | Description |

|---|---|

| 1. Transaction Pool | Transactions are broadcast to the network and grouped into a “block”. |

| 2. Puzzle Challenge | Miners must find a hash value (using SHA-256 in Bitcoin) that is below a specific target. |

| 3. Nonce Guessing | Miners rapidly change a “nonce” (a random number) to generate different hashes. |

| 4. Hashing | Each attempt involves hashing the block’s data + nonce. |

| 5. Success | When a valid hash is found, the block is broadcast and added to the chain. |

| 6. Reward | The winning miner gets crypto + transaction fees. |

It’s like a global lottery where electricity buys you tickets — and only one winner gets paid every 10 minutes.

📉 Difficulty Adjustment: How the Network Stays Balanced

To prevent blocks from being mined too quickly or too slowly, Bitcoin adjusts the difficulty every 2016 blocks (approximately every 2 weeks).

If miners are solving puzzles too fast, the network makes the target hash harder to reach. If too slow, it gets easier. This keeps the average block time close to 10 minutes — no matter how much mining power joins or leaves the network.

🔥 Why It’s So Energy-Intensive

To solve the cryptographic puzzle, miners perform quintillions of calculations per second. That requires:

- Industrial-grade ASICs (Application-Specific Integrated Circuits)

- Warehouses full of cooling fans

- Electricity bills that can dwarf those of small towns

As of 2025, the Bitcoin network uses more electricity than countries like Norway or Argentina.

Security in PoW comes from waste — making it prohibitively expensive for bad actors to rewrite history.

🛡️ Security Through Work

PoW’s genius lies in its brutal simplicity:

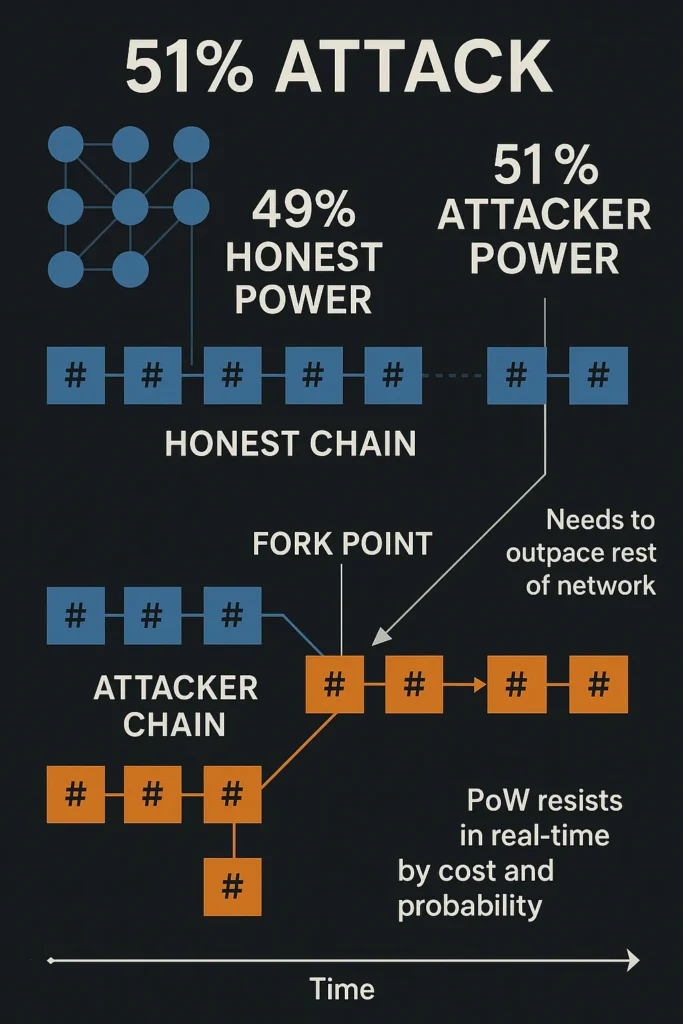

- To attack the network, you’d need to recreate every block and solve each puzzle faster than the rest of the network.

- That means owning more than 50% of total mining power — a 51% attack — which is theoretically possible but practically absurd for large blockchains.

This “economic firewall” protects Bitcoin and other PoW coins from tampering.

🧠 The Game Theory Behind PoW

Proof of Work aligns incentives brilliantly:

- Miners are financially motivated to play fair.

- Any attempt to cheat the system would cost more than the potential reward.

- The harder they work, the more secure the network becomes.

It’s capitalism-meets-cryptography — a self-reinforcing economic engine based on honest labor.

⚖️ PoW vs. PoS: A Battle of Philosophies

| Feature | Proof of Work | Proof of Stake |

| Security | Based on computational difficulty | Based on financial stake |

| Energy Use | Extremely high | Much lower |

| Hardware Need | Expensive ASICs | Just a computer and coins |

| Centralization Risk | High (large mining pools dominate) | Medium (rich stakeholders dominate) |

| Attack Cost | Requires massive physical resources | Requires buying up majority of stake |

Ethereum, the world’s second-largest blockchain, abandoned PoW in 2022 to embrace Proof of Stake (PoS). Why? Because of energy concerns, scalability, and accessibility.

But Bitcoin still runs on PoW — and defenders argue it’s the most proven and decentralized method in existence.

🧱 Real-World Use Cases of PoW

| Project | Description |

| Bitcoin (BTC) | The original and largest PoW network. |

| Litecoin (LTC) | A faster, lighter version of Bitcoin with Scrypt algorithm. |

| Monero (XMR) | Privacy-focused coin that resists ASIC domination. |

| Dogecoin (DOGE) | Initially a meme, now a top PoW coin co-mined with Litecoin. |

Some lesser-known blockchains (like Ravencoin and Kaspa) also experiment with new PoW variations.

🌍 Geographic Hotspots of Mining

Major mining operations are now concentrated in regions with cheap and stable electricity:

- Iceland: Powered by geothermal and hydro energy

- Texas, USA: Deregulated energy market and surplus wind power

- Kazakhstan: Low energy cost, but tightening regulations

- Russia and China (some provinces): Hydro and coal-based mining (subject to shifting policy)

This global distribution impacts decentralization — if one country bans mining, others quickly fill the gap.

💰 Economics of Mining: Is It Still Profitable?

Mining has shifted from garages to industrial-scale operations:

- Home miners struggle due to electricity costs and hardware obsolescence.

- Mining farms use economies of scale and locate near cheap power.

Profitability depends on:

- Electricity cost

- Hardware efficiency (Joules per TH/s)

- Market price of the coin

In 2025, only regions with ultra-cheap energy and access to modern ASICs can mine profitably.

🔄 Hybrid Models in Practice: PoW + PoS

Some projects combine Proof of Work with Proof of Stake for hybrid security models:

- Decred (DCR): PoW miners propose blocks; PoS validators approve them.

- Elastos (ELA): Mixes traditional mining with consensus voting.

These models aim to balance energy use with decentralization and economic fairness.

🔍 Deep Dive: SHA-256 Explained Simply

SHA-256 is a cryptographic hash function used in Bitcoin’s PoW:

- It takes input (block data + nonce) and returns a fixed 256-bit hash.

- The output is deterministic but unpredictable.

- To mine a block, the resulting hash must start with a set number of zeros (depending on difficulty).

Hashing is fast, but finding the right hash is pure guesswork — hence the massive energy use.

🌎 Environmental Debate

PoW’s environmental cost has made it a lightning rod for criticism:

- Carbon emissions from coal-powered mining farms (especially in regions with fossil-fuel energy grids)

- E-waste from obsolete ASIC hardware

- Water and land usage for cooling infrastructure

Some projects are exploring green PoW (using renewable energy), but critics argue that no amount of solar panels can justify unnecessary computation.

The question isn’t whether PoW works — it’s whether it’s worth it.

🔮 The Future of Proof of Work

Is PoW obsolete?

Not quite. While critics push for greener alternatives, PoW still:

- Secures the world’s most valuable blockchain (Bitcoin)

- Provides transparent, predictable issuance

- Offers truly decentralized validation (no elite validators)

Innovations on the horizon include:

- Hybrid models (PoW + PoS)

- ASIC-resistant algorithms (e.g., RandomX for Monero)

- Renewable energy mining zones and carbon-offset protocols

The ultimate question is philosophical: should energy be spent to secure digital truth?

🧭 Final Thoughts: Brutal but Beautiful

Proof of Work isn’t elegant. It’s not efficient. It doesn’t scale like newer systems.

But it works — reliably, transparently, and independently of politics or institutions. It’s digital security built on physical sacrifice. Brutal math. Honest power.

If Bitcoin is digital gold, Proof of Work is the pickaxe that keeps it rare.

📚 Glossary

- Proof of Work (PoW): A consensus algorithm that requires computational effort to validate transactions.

- Nonce: A number used once to find a valid hash.

- Hash (SHA-256): A cryptographic function that outputs a fixed-size value from variable input.

- 51% Attack: When an entity controls over 50% of mining power and can alter the blockchain.

- ASIC: Specialized hardware for mining crypto.

- Consensus Mechanism: A method to agree on a single version of the blockchain.

- Difficulty Adjustment: An automatic mechanism to maintain consistent block timing.

- Hybrid PoW/PoS: A system that mixes Proof of Work and Proof of Stake to achieve balance.

❓ FAQ Q: Why not switch Bitcoin to Proof of Stake?

A: Bitcoin’s developers and community prioritize decentralization, auditability, and long-term security — even at the cost of energy.

Q: Can someone still attack a PoW blockchain?

A: Technically yes, but the cost would be astronomically high — especially on large networks.

Q: Is all PoW energy wasted?

A: It depends on your philosophy. Some argue that securing an open monetary network is worth the energy cost.

Q: What makes PoW so secure?

A: The immense computational effort required to rewrite history makes tampering unprofitable.

Q: Is mining still profitable in 2025?

A: Only for industrial-scale miners with access to cheap power and modern ASICs. Home mining is largely unprofitable.