⚠️ Disclaimer

This article is for educational purposes only. It does not constitute legal advice or endorse any investment or technological implementation without proper compliance with local laws and regulations.

🔍 Introduction: The Contract That Signs Itself

Imagine signing a contract that executes itself automatically — no lawyer, no notary, no middleman. Imagine a vending machine for legal agreements: you insert conditions and cryptocurrency, and out pops a result — irrevocable, transparent, unstoppable.

That’s not the future. That’s a smart contract.

Born from the ideas of cryptographers and fueled by blockchain technology, smart contracts are now reshaping everything from finance to logistics, healthcare, gaming, and even governance. They’re not “smart” like AI, and they’re not “contracts” in the traditional legal sense. But they just might be the most disruptive force in digital trust since the internet itself.

Let’s unpack what they are, how they work, where they shine, where they fail — and why they matter.

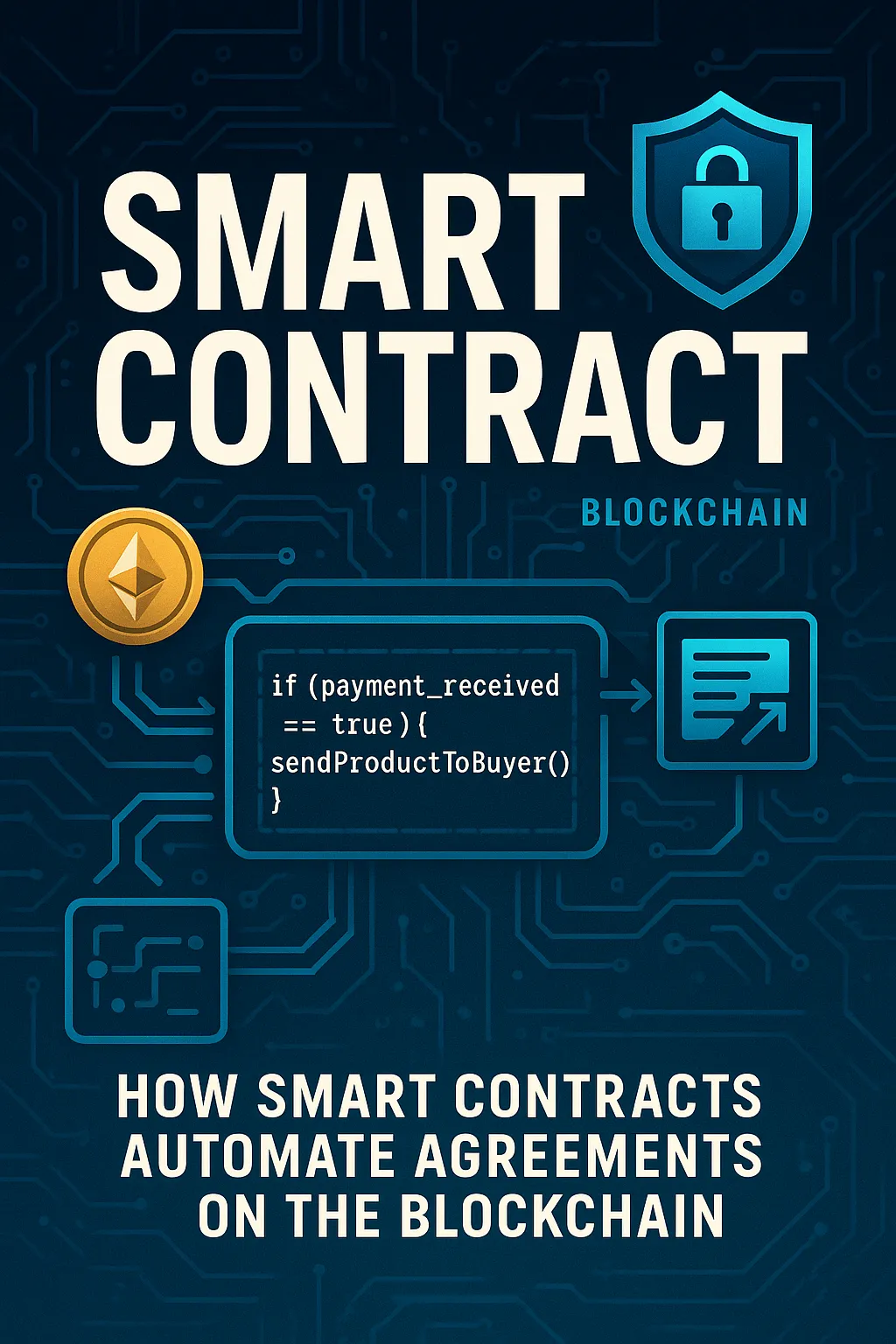

🧠 What Is a Smart Contract?

At its core, a smart contract is a piece of code that lives on a blockchain and performs actions automatically when specific conditions are met. Think of it as an “if this, then that” script with real-world consequences.

But unlike traditional software, a smart contract is:

- Immutable: Once deployed, its code can’t be changed.

- Decentralized: It runs on a blockchain like Ethereum, not on a company server.

- Transparent: Anyone can inspect the logic and verify outcomes.

- Trustless: It doesn’t require users to trust each other — just the code.

Here’s the kicker: it’s enforceable not by courts or police, but by mathematics.

🧱 The Technical Backbone: Code Meets Blockchain

Let’s strip the jargon.

A smart contract is typically written in a language like Solidity (on Ethereum), Rust (for Solana), or Vyper. It gets deployed to a blockchain, where it receives its own address — just like a user. Anyone can send data, tokens, or calls to that address, triggering the contract’s code.

Example:

solidityif (payment_received == true) {

sendProductToBuyer();

}

On a blockchain, that’s not a promise — it’s an automatic action. No human intervention. No delays.

Behind the scenes:

- Inputs are transactions (e.g., a wallet sends funds).

- The contract checks the logic.

- Outputs are on-chain actions (e.g., sending tokens, minting NFTs, unlocking access).

It’s software with a bank account. And it never sleeps.

🧭 A Brief History: From Legal Theory to Digital Revolution

The concept of smart contracts predates blockchains.

In 1994, cryptographer and legal scholar Nick Szabo coined the term. He envisioned digital protocols that could enforce the terms of a contract without third-party involvement. His classic analogy? A vending machine: you insert money and get a product. No human trust required.

But his ideas remained theoretical until 2009, when Bitcoin introduced a decentralized ledger. Then came Ethereum in 2015 — the first blockchain built not just to store value, but to run code.

Ethereum made smart contracts programmable, accessible, and — most importantly — unstoppable. Suddenly, code could mediate billion-dollar decisions.

💡 What Can Smart Contracts Actually Do?

They’re not just a novelty. Here’s what smart contracts are doing right now:

| Use Case | Description | Real-World Examples |

|---|---|---|

| DeFi (Decentralized Finance) | Lending, borrowing, trading without banks | Uniswap, Aave, Compound |

| NFTs | Minting, selling, and transferring digital assets | OpenSea, Foundation |

| DAOs (Decentralized Autonomous Organizations) | Code-governed communities making decisions on-chain | MakerDAO, Aragon |

| Supply Chain | Tracking goods with transparency and automation | IBM Food Trust, VeChain |

| Escrow Services | Holding funds until predefined conditions are met | CryptoPunks sales, real estate pilots |

| Gaming | Smart rewards, loot drops, and economies | Axie Infinity, Gods Unchained |

Smart contracts are essentially financial Lego bricks — composable, programmable, and global.

🎯 Why They Matter

Traditional contracts rely on trust. You trust the other party will fulfill their promise. If not, you go to court. It’s slow, expensive, and unpredictable.

Smart contracts replace trust with verification.

Here’s why that’s revolutionary:

- No middlemen: Reduces costs in finance, law, and logistics.

- Global reach: A smart contract works the same in Tokyo or Timbuktu.

- 24/7 automation: Contracts execute instantly, even at 3:00 a.m.

- Censorship resistance: No central party can stop execution (unless coded to do so).

They’re not just tools — they’re trust engines.

⚠️ Where Smart Contracts Go Wrong

Let’s drop the hype for a second.

Smart contracts are still contracts — and contracts are complicated.

The Limitations:

- Bugs = Bankruptcy

Smart contracts are unforgiving. A single coding mistake can lock or drain millions. The infamous 2016 DAO hack on Ethereum cost over $50 million and led to a blockchain fork. - Law vs. Code

Just because a smart contract executes doesn’t mean it’s legally valid. Jurisdictions vary. Courts might not recognize an on-chain agreement as binding. - Oracle Problem

Contracts often need external data (e.g., weather, sports scores, stock prices). How do you get that into the blockchain without trusting someone? Enter oracles — themselves potential points of failure. - User Error

Users send funds to the wrong contract or interact with a fake one. There’s no “undo” button. - Governance

Who updates the code? Who handles disputes? Many projects hard-code immutability — then regret it later.

This isn’t magic. It’s math. And it needs oversight.

🌐 Legal and Regulatory Landscape

Governments are catching up.

- U.S.: In some states, smart contracts are legally recognized (e.g., Arizona, Tennessee).

- EU: Smart contracts fall under eIDAS regulation but remain in a legal gray area.

- China: Actively exploring smart contracts for digital yuan settlements.

- Global trend: From law firms to central banks, institutions are testing how to integrate — or regulate — code-based agreements.

The question isn’t whether smart contracts will be regulated. It’s how deeply they’ll be intertwined with traditional systems.

🔐 Security: The Achilles Heel

A smart contract is only as secure as its code. And blockchain hacks have become a billion-dollar business.

In 2022–2024 alone:

- Over $3 billion was lost due to smart contract vulnerabilities.

- Most exploits came from reentrancy bugs, unchecked external calls, and flawed math logic.

That’s why “audits” — third-party reviews of contract code — are now a must. Some platforms, like Certik or Trail of Bits, have become as important as the contract itself.

Still, no audit can guarantee perfection. Once a contract is deployed, it’s like launching a satellite — hard to bring back.

🛠️ Tools of the Trade

Want to create or inspect a smart contract? Here’s the toolbox:

| Tool | Purpose |

|---|---|

| Remix IDE | Web-based Solidity editor |

| Hardhat / Truffle | Development frameworks for testing and deployment |

| Etherscan | Blockchain explorer to view smart contracts |

| Chainlink | Oracle network for external data |

| OpenZeppelin | Secure libraries for common contract patterns |

| MythX / Slither | Static analysis tools for vulnerability detection |

You don’t need to be a developer to understand them — but if you plan to interact with smart contracts, basic literacy helps.

🧭 The Future: Smarter, Safer, Invisible

Smart contracts won’t replace all lawyers or banks. But they will reshape how agreements are made, enforced, and automated.

Trends to watch:

- AI + Smart Contracts: Automating the writing of safe, context-aware contracts.

- Layer 2 Scaling: Faster, cheaper execution with networks like Arbitrum or Optimism.

- Interoperability: Contracts that work across chains (Polkadot, Cosmos).

- Regulated DeFi: Legal-compliant smart contracts for mainstream finance.

- Invisible UX: Users interacting with contracts without even knowing — like how we use HTTPS today.

In the future, you won’t “use” smart contracts. You’ll just… use apps. The contract will be the infrastructure, not the interface.

🧠 Final Thoughts

Smart contracts are not science fiction. They’re already writing the rules of tomorrow’s economy — in code.

They’re empowering new kinds of businesses, communities, and financial systems. But they’re also exposing new kinds of risks, from hacks to legal uncertainty. The same qualities that make them powerful — immutability, transparency, decentralization — also make them dangerous if misunderstood.

Like fire, smart contracts can warm or burn. The difference lies in who writes the code, who audits it — and who understands the deal before they click “Confirm.”

📚 Glossary

| Term | Meaning |

|---|---|

| Solidity | Programming language for Ethereum smart contracts |

| Oracle | A service that brings real-world data to the blockchain |

| DAO | Decentralized Autonomous Organization — managed by code, not people |

| Reentrancy | A type of attack where a contract is repeatedly called before finishing execution |

| Immutable | Cannot be changed once deployed |

| Layer 2 | A secondary blockchain that scales a primary chain like Ethereum |

| Gas | The fee paid to execute a transaction or contract on the blockchain |

❓ FAQ

Q: Are smart contracts legally binding?

A: Not always. Legal recognition varies by country and context. They automate execution but may need additional legal agreements.

Q: Can smart contracts be changed after deployment?

A: Generally no. Some use upgradeable patterns, but immutability is often a feature — and a risk.

Q: Are smart contracts safe?

A: They can be — if written and audited well. But many contain vulnerabilities. Always use caution.

Q: Can smart contracts run without Ethereum?

A: Yes. Other platforms like Solana, Avalanche, Cardano, and Polkadot also support them.

Q: Who controls a smart contract once it’s deployed?

A: Usually, no one. That’s the point. But some have admin keys or governance mechanisms.